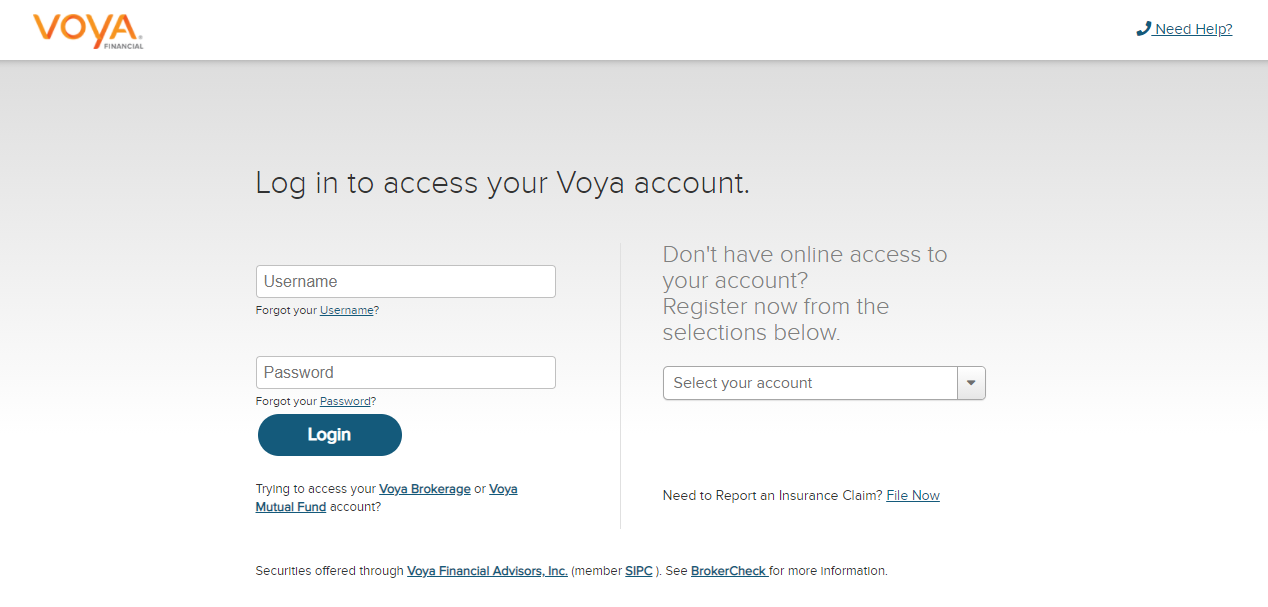

Voya Financial Log In:

- To login open the website www.voya.com

- As the page appears at the center click on the ‘Login’ button.

- In the next screen, you have to choose your suitable account.

- For example hit on the ‘Login’ button under the ‘Retirement’ section, or go to my.voya.com/voyassoui page

- You have to provide the login information hit on ‘Login’ button.

Retrieve Voya Financial Login Initials:

- To reset the login details open the page my.voya.com/voyassoui

- After the page appears in the login screen hit on the ‘Forgot your username’ button.

- You have to enter your SSN or tax ID number, date of birth click on the ‘Continue’ button.

- For password reset enter a username, SSN, or tax ID and follow the prompts.

Register for Voya Financial Account:

- To register for the account open the website www.voya.com

- As the page opens in the login screen you have to select your account

- Now you have to proceed with the prompts.

Also Read : How to Pay Chase Bank Bill Online

Login to Voya Financial Account :

Clients need to work with organizations whose qualities line up with theirs and who comprehend the business benefit of working straightforwardly and morally. Discover more about the personality of their image and the solid culture that keeps on distinctive them from their companions.

Why Choose Voya Financial:

- Commending their disparities is the establishment of an incredible work environment.

- Deciding to incorporate is the following stage in the making of a climate

- every individual feels great to carry their entire self to work and be real.

Tips to prepare for an unusual tax season:

- Make an Arrangement and Start Early: Start by recognizing how you will record your assessments, for example, through an online program or with the assistance of an expert master. Accumulate all tax documents, for example, W-2s from your manager or a 1099 structure in case you’re independently employed, pertinent cost receipts, just as articulations from banks or other monetary foundations. The snappier you get your assessments recorded, the quicker you’ll get your return. Visit IRS.gov for the most recent expense data.

- Check for Tax Reductions and Allowances: Due to the pandemic, you may have needed to make significant way of life changes, some of which could bring about a tax reduction or derivation that decreases your sum owed. The expense of setting up a home office, the acquisition of a vehicle in lieu of taking public transportation and childcare costs are largely instances of conceivable tax breaks or derivations.

- Consider Extra COVID-19 Effects: If you lost employment because of COVID-19 and got joblessness benefits, recall that pay is available. The CARES Act likewise made arrangements that could profit your government form, including permitting over the-line derivations for gifts to good cause, deferring the punishment for early withdrawal from retirement records and that’s only the tip of the iceberg.

- Work with an Assessment Readiness Administration: Feeling overpowered? Working with a respectable expense planning administration accomplice can assist you with distinguishing extra derivations accessible and can add to your return. In an abnormal year, recording duties can accompany extra pressure and vulnerability.

- Basic Instincts: Following some basic hints can help guarantee you secure the most ideal outcome. Having arranged around 84,000 returns a year ago, World Finance is offering tips to decrease charge season migraines this year, while assisting you with amplifying the worth and idealness of your government form.

Voya Financial Customer Service:

To get further assistance call on 800-584-6001.

Reference Link: